Welcome to the era of contactless payments. Tapping a payment card on a terminal is so commonplace today that few can imagine modern life without it. RFID (Radio-Frequency Identification) and NFC (Near Field Communication) technology have revolutionized not only how we pay, but also how we carry our documents. However, this speed and convenience also bring new, invisible risks. We're talking about the threat of digital data theft, or skimming.

As specialists in travel and everyday accessories at Bagalio, we know that security is as important as style. That's why, in this comprehensive guide, we will dive deep into the world of RFID card protection. You'll find out what RFID protection is, how it effectively protects you from thieves with modern technology, and which products from our range can help you ensure maximum security for your payment cards and documents. This article will teach you how to protect yourself from digital theft.

Contents:

- How RFID and NFC Technology Work and Why Card Protection is Necessary

- With RFID Protection Against Theft: The Principle of Signal Blocking

- Wallets, Cases, and Other Products with RFID Protection

- Myths and Facts About the Protection and Misuse of Payment Cards

- Enhance Your Digital Security: Tips for Safe Handling

- How RFID Technology Works – Frequently Asked Questions

How RFID and NFC Technology Work and Why Card Protection is Necessary

To understand the principle of the protective solution, we must explain the threat. RFID technology is used everywhere – from tracking goods and logistics to workplace identification. When we talk about payment cards, we're talking about a passive RFID chip that operates without its own power source.

Passive RFID Chips and the Risk of Data Reading

The chip in a payment card activates and sends data only when a reader emits a signal at a specific frequency (most commonly 13.56 MHz for contactless cards). This type of communication is known as NFC (Near Field Communication), a technology based on RFID principles.

Here's the problem: A thief with a modified mobile reader can send a signal that wakes up the chip and reads sensitive information, such as your payment card number and expiration date. This technique is called skimming. In a crowded space, without you noticing a thing, they can illegally read the cards and misuse the data.

Risks associated with contactless technology:

- Skimming: Unauthorized remote reading of data from the card's chip.

- Misuse of obtained data: Creating a clone of the card or using the data for fraudulent online payments.

With RFID Protection Against Theft: The Principle of Signal Blocking

RFID protection is a barrier that prevents radio waves from reaching the chip in your card. It is the most effective way to prevent unwanted data reading.

How Does RFID Protection Work? (Faraday Cage)

The principle on which RFID protection is based is old and reliable – the Faraday cage. Wallets or cases with protection have an integrated layer of metallic material, most often aluminum foil, which is capable of shielding electromagnetic waves and preventing signal transmission.

- The reader emits radio waves to activate the chip.

- These radio waves hit the protective layer inside the wallet.

- The metallic layer reflects or absorbs them, resulting in signal blocking. RFID protection thus interrupts communication via NFC technology, and the chip does not activate.

- The data remains safe.

Thanks to this principle, your card is continuously protected from unauthorized reading. As soon as you take the card out, the protection is temporarily deactivated, allowing for seamless payment at an authorized terminal.

Did you know... that the invention of the Faraday cage is credited to the famous British physicist Michael Faraday? He introduced it back in 1836 as an effective way to shield an electric field. Today, this principle protects your payment cards from modern digital data theft.

Wallets, Cases, and Other Products with RFID Protection

At Bagalio, we offer a whole range of products with RFID protection, differing in their level of integration and use. Today, RFID protection is not just for wallets and cases, but also for larger items like handbags, bags, backpacks, and bum bags.

Tip: To find the right luggage that will protect you from digital data misuse, simply check "Yes" on the RFID card protection filter in our e-shop.

Special RFID Wallets and Cases

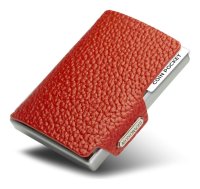

Investing in an RFID wallet is an investment in peace of mind. These wallets have the protective material built into the inner lining or directly into the structure (aluminum cases).

| Product | Description and Benefits | Ideal For |

|---|---|---|

| Wallet with RFID Protection | The protective foil is discreetly integrated into the inner lining of the wallet. Complete protection for all pockets. | For lovers of classic and leather accessories who want maximum comfort. |

| Aluminum Card Case | A minimalist solution where the case itself is a functional Faraday cage. Offers excellent card organization. | For those who mainly carry credit and contactless cards and minimize cash. |

Extended Protection: Backpacks, Bags, and Bum Bags

For those who also want to protect their travel documents or have a non-RFID wallet, handbags and bags with RFID protection, backpacks with RFID protection, and bum bags with RFID protection are ideal. In these larger items, the RFID-blocking material is integrated into one, specially designated pocket. This pocket serves as a safe place to store a payment card, passport, or mobile phone. Always make sure to place the card in the pocket marked **"RFID Protected"** to ensure protection.

Tip: Choose from our wide range of travel luggage the one that best fits the maximum carry-on dimensions of the airline you fly with most often. Before your trip, just to be sure, remind yourself what you can and cannot take on board a plane.

Myths and Facts About the Protection and Misuse of Payment Cards

It's necessary to be clear about what RFID protection can and cannot do. Widespread misconceptions can lead to a false sense of security.

Myths and Facts about RFID Protection:

- Myth: Radio Frequency Identification is an old technology and therefore carries no risks.

- Fact: Although it is old, contactless cards and documents still use it. That is why RFID protection is necessary.

- Myth: I have a limit on contactless payments, so skimming doesn't affect me.

- Fact: Skimming is used to steal personal data, which can then be misused for payments abroad or to create a clone of the card. The limit on a contactless transaction does not protect you from data theft.

- Myth: Only expensive wallets have reliable protection.

- Fact: The key is the integrated aluminum foil or metal construction. Even affordable wallets can have certified and functional RFID protection.

Enhance Your Digital Security: Tips for Safe Handling

RFID protection is your invisible guardian, but personal responsibility and caution are just as important. Here are a few tips to increase the security of your payment cards:

- Regular Account Checks: Set up notifications for every transaction and monitor your statements to detect any potential data misuse in a timely manner.

- Card Organization: In an RFID wallet, organize your cards so that the protection is effective – the inner pockets and aluminum modules are most often protected.

- Minimalism: Carry only the cards and documents necessary for the day to reduce the risk of loss or theft.

- Beware of Terminals: Skimming devices are often cheap plastic or metal attachments that mimic the design of the device.

How to visually inspect a terminal or ATM:

- Movement: Try touching the card reader and keypad and gently wiggling them. Skimmers are usually glued or placed on top of the original device and are not part of the solid construction.

- Appearance: Look for inconsistencies in color, material, or shape – skimmers often look bulkier or have edges that don't match the original device.

- Camera: At ATMs, check if there is a small hole or a stuck-on plastic cover above the keypad or nearby that could hide a miniature camera recording the PIN.

- Keypad: Always cover your hand over the keypad when entering your PIN, even if the terminal seems secure.

How RFID Technology Works – Frequently Asked Questions

- How can I protect my cards from skimming?

Protection against skimming involves using a wallet or pocket with RFID protection, which blocks radio waves and thus protects your cards stored inside from illegal data copying. - What are the benefits of using a wallet with RFID protection?

Wallets with RFID protection serve to shield electromagnetic waves, meaning they block communication between your card and readers. This significantly reduces the risk of theft and misuse of your personal data. - What cards can I protect with RFID technology?

RFID technology can protect various types of cards, including credit and debit cards, identification cards, and other contactless cards that contain chips. - Can I use RFID protection for all my cards?

Yes, most wallets with RFID protection are designed to hold multiple cards and protect them from unwanted data copying.

Invest in Peace of Mind and Security: Opt for RFID Protection

As we have described in detail, data theft via RFID technologies is a real risk that lurks at every turn. Therefore, RFID card protection should be a standard feature of your wallet, handbag, or backpack.

Don't let them rob you silently. Secure your payment cards and documents with certified RFID protection. At Bagalio, you will find the ideal combination of elegance and maximum security – from minimalist card cases and classic wallets to backpacks and handbags with special RFID pockets.

Stop worrying about skimming. Browse our entire collection of RFID products and invest in your peace of mind today!